Ohio Mortgage Eligibility Calculator

Buying your first home in Ohio isn’t just about finding the right neighborhood or checking off must-have features. One of the biggest hurdles for first-time buyers is understanding the credit score needed to get approved for a mortgage. It’s not a single number everyone must hit - it’s a range, and what you need depends on the type of loan you’re applying for. But here’s the simple truth: you can buy a house in Ohio with a credit score as low as 500 - if you’re willing to put down a big down payment. Most people, though, will need something closer to 620 to 640 to get decent terms.

How Credit Scores Work for Mortgages in Ohio

Your credit score is a three-digit number that lenders use to guess how likely you are to pay back a loan. In Ohio, like everywhere else in the U.S., mortgage lenders mostly look at FICO scores, which range from 300 to 850. The higher your score, the better your interest rate and the easier it is to qualify. But lenders don’t just look at one number. They also check your credit history - how long you’ve had credit, whether you’ve missed payments, and how much debt you carry compared to your limits.

For example, if you’ve had a credit card for five years and always paid on time, but you recently maxed it out, your score might dip even if you’ve never missed a payment. Lenders care about patterns, not just numbers.

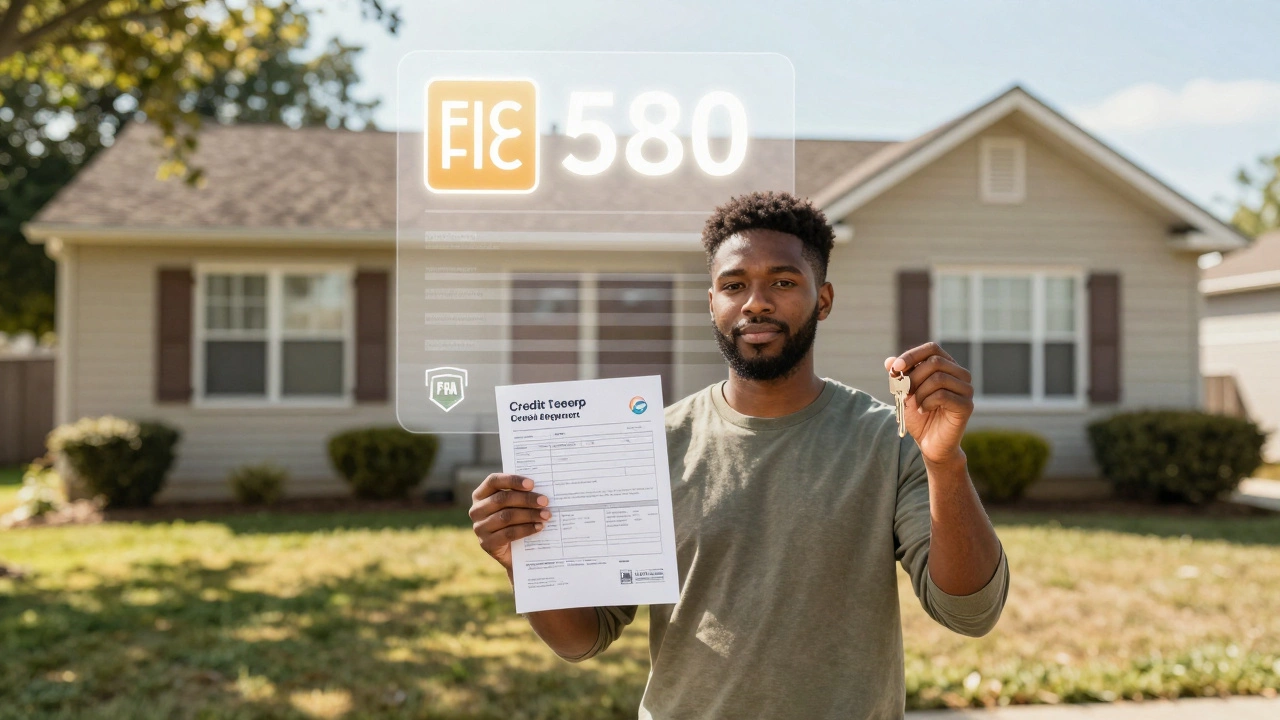

FHA Loans: The Easiest Path for First-Time Buyers

If you’re buying your first home in Ohio and don’t have a lot saved for a down payment, the FHA loan is your best friend. These loans are backed by the federal government and designed for people with lower credit scores or limited savings.

- With a credit score of 580 or higher, you can put down as little as 3.5%.

- With a score between 500 and 579, you can still qualify - but you’ll need to put down at least 10%.

That means someone with a 520 credit score could buy a $200,000 house in Ohio with $20,000 down. It’s not easy, but it’s possible. FHA loans also allow gift funds for the down payment, so if a relative helps out, that’s allowed.

Keep in mind: FHA loans require mortgage insurance for the life of the loan if you put down less than 10%. That adds about $100-$150 per month to your payment, depending on the loan amount and your score. So while FHA loans open the door, they come with ongoing costs.

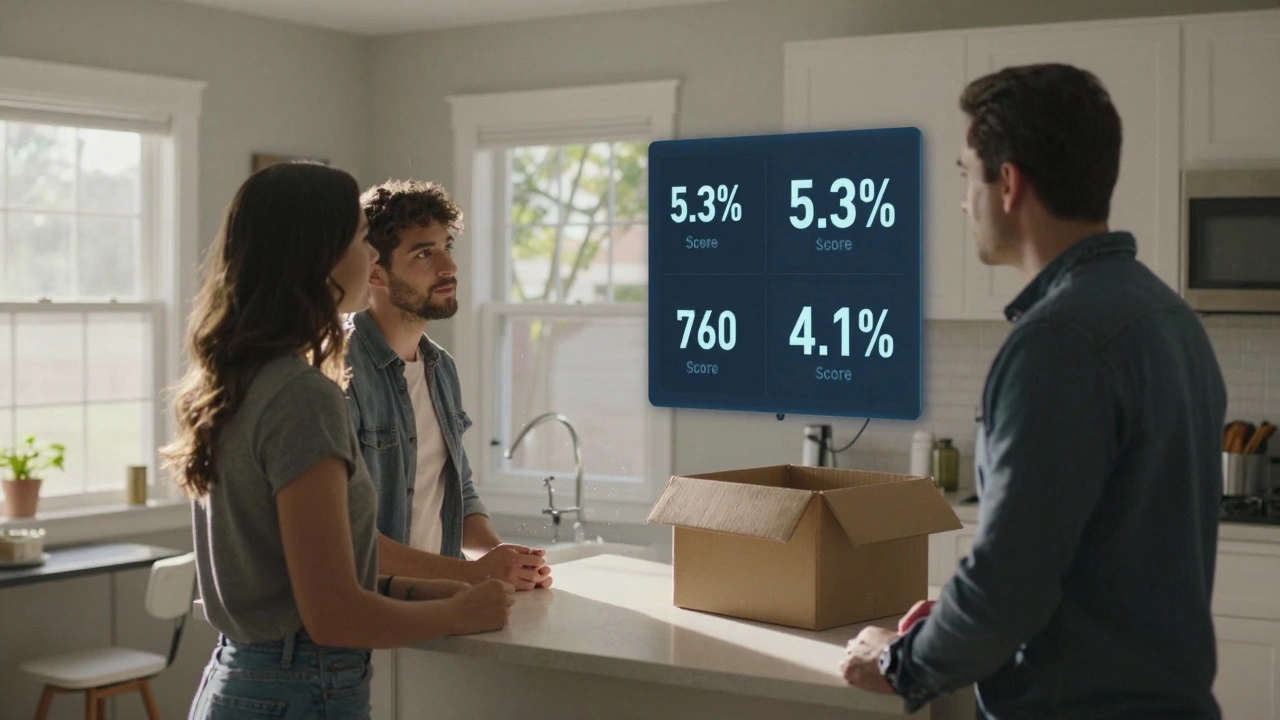

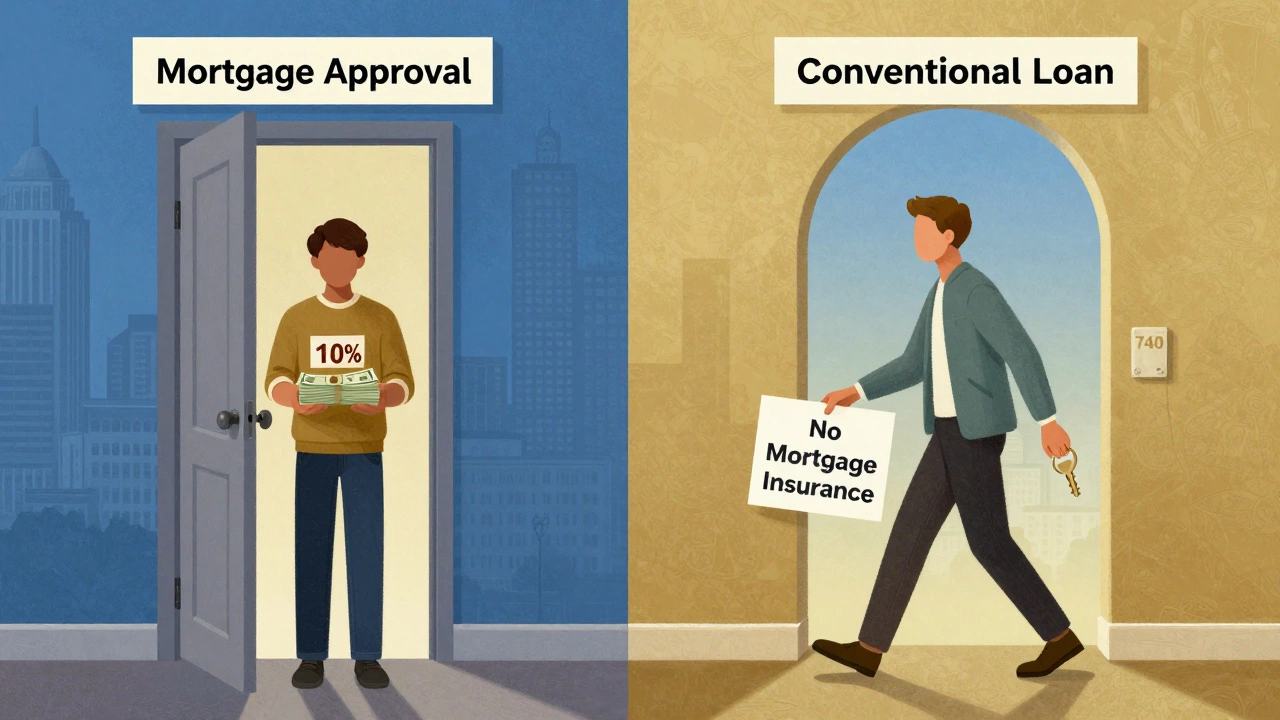

Conventional Loans: Higher Scores, Better Rates

If you’ve got a score above 620 and can afford a 5% down payment, a conventional loan might be better. These loans aren’t government-backed, so lenders set their own rules. Most banks and mortgage companies in Ohio require at least a 620 score for conventional loans, but the sweet spot is 700 or higher.

Why aim higher? Because a score above 740 can save you thousands. For a $250,000 mortgage, someone with a 760 credit score might pay 4.1% interest, while someone with a 640 score could pay 5.3%. That’s a $150 difference per month - over $54,000 extra over 30 years.

Conventional loans also don’t require mortgage insurance if you put down 20% or more. That’s a big reason why people with good credit skip FHA loans entirely.

VA and USDA Loans: Special Options for Some Buyers

If you’re a veteran or active-duty service member, VA loans in Ohio have no minimum credit score requirement. Lenders typically want 620, but some will go lower if your income and debt are stable. VA loans also require zero down payment and no mortgage insurance.

For buyers in rural or suburban areas of Ohio, USDA loans are another option. These are for low- to moderate-income families in eligible zip codes. The minimum credit score is usually 640, but some lenders accept 620. USDA loans also offer zero down payment and low interest rates.

What If Your Score Is Below 500?

If your credit score is under 500, you won’t qualify for any federal-backed mortgage in Ohio. Not FHA, not VA, not USDA. At that point, you need to fix your credit before you start house hunting.

Start by getting a free copy of your credit report from AnnualCreditReport.com. Look for errors - like old debts that were paid off but still show as unpaid. Dispute them. Pay down credit card balances. Don’t open new credit accounts. And always pay bills on time. Even small improvements matter. One Ohio woman raised her score from 490 to 610 in eight months by just paying her phone bill on time and reducing her credit card use by 70%. She bought her first home in Columbus last year.

Other Factors Beyond Your Credit Score

Your credit score isn’t the whole story. Lenders also look at:

- Debt-to-income ratio (DTI): Your monthly debt payments (car loan, student loans, credit cards) divided by your gross monthly income. Most lenders want this under 43%.

- Down payment: The more you put down, the more forgiving lenders are about your score.

- Employment history: Two years of steady income is the standard. Freelancers and gig workers need more documentation.

- Loan type: FHA, VA, USDA, and conventional loans all have different rules.

For example, someone with a 600 credit score but a 15% down payment and no other debt might get approved faster than someone with a 680 score but $800 in monthly car and student loan payments.

How to Check and Improve Your Credit Score

You can check your credit score for free every month through many banks and credit card apps. You can also get a free report once a year from AnnualCreditReport.com. Don’t use random websites - stick to trusted sources.

To raise your score fast:

- Pay all bills on time - even small ones like your gym membership or Netflix.

- Keep credit card balances under 30% of your limit. Ideally under 10%.

- Don’t close old credit cards - they help your credit history length.

- Avoid applying for new credit in the 6 months before you apply for a mortgage.

- Ask your lender for a pre-approval letter. It’s not a guarantee, but it tells you where you stand.

There’s no magic trick. But if you’ve been consistent for six months, you’ll see real movement.

Ohio-Specific Tips for First-Time Buyers

Ohio has some local programs that help first-time buyers with down payment assistance. Cities like Cleveland, Cincinnati, and Toledo offer grants or low-interest second loans that don’t need to be repaid if you live in the home for five years. These programs often have lower credit score requirements than standard loans.

For example, the Ohio Housing Finance Agency (OHFA) offers a Homebuyer Program that allows credit scores as low as 620 for first-time buyers with income limits. They also offer up to $10,000 in down payment help. You can’t use it with every lender, but if you’re working with a local mortgage broker who knows the program, it can make a huge difference.

Don’t assume you need perfect credit to buy in Ohio. Many buyers get in with scores in the 600s. The key is knowing which loan type fits your situation and preparing ahead.

What is the lowest credit score to buy a house in Ohio?

The lowest credit score to buy a house in Ohio is 500, but only if you’re using an FHA loan and can put down at least 10% of the home’s price. Most lenders prefer a score of 620 or higher for better rates and more loan options.

Can I buy a house in Ohio with a 580 credit score?

Yes. With a 580 credit score, you can qualify for an FHA loan with a 3.5% down payment. Many first-time buyers in Ohio use this path. You’ll pay mortgage insurance, but it’s often the only way to get into the market with limited savings.

Does Ohio have special programs for first-time homebuyers with low credit scores?

Yes. The Ohio Housing Finance Agency (OHFA) offers down payment assistance and low-interest loans for first-time buyers. Some programs accept credit scores as low as 620 and provide up to $10,000 in help. Local city programs in Cleveland, Cincinnati, and Toledo also offer grants that don’t need repayment.

How long does it take to improve a credit score to buy a house?

It can take as little as 3-6 months to see a meaningful improvement if you pay bills on time, reduce credit card debt, and avoid new credit applications. Most people who go from 550 to 640 do it within a year with consistent effort.

Do I need a perfect credit score to get a mortgage in Ohio?

No. You don’t need perfect credit. In fact, most Ohio homebuyers don’t have scores above 700. The key is matching your score to the right loan type - FHA, VA, USDA, or conventional - and having enough down payment and stable income to back it up.

Next Steps for Ohio First-Time Buyers

Start by pulling your credit report. If your score is below 620, focus on fixing it before you start looking at homes. Talk to a local mortgage broker who knows Ohio’s first-time buyer programs - not just a big bank. They’ll know about grants, down payment help, and lenders who work with scores in the 600s.

Don’t wait for perfect credit. Wait for the right plan. Many people in Ohio buy their first home with a score between 600 and 650. You can too - if you know what to look for and where to go for help.