Shared Ownership Income Calculator

Your Business Financials

Lender Requirements

Your Financial Summary

RecommendedSalary Option:

Owner's Draw Option:

Lenders typically require at least 6 months of consistent income to approve shared ownership mortgages. Your current income structure shows unstable patterns which could negatively impact your application.

If you own part of a home through shared ownership and run a business from it-or even just manage your finances like a small business-you’ve probably wondered: should I pay myself a salary or take money out as an owner’s draw? It’s not just about tax. It’s about cash flow, stability, and how the government sees your income. And the wrong choice can cost you thousands-or even block your ability to get a mortgage later.

What’s the difference between a salary and an owner’s draw?

A salary is a fixed, regular payment you make to yourself from your business, like an employee. It’s processed through payroll. Taxes are withheld automatically-income tax, National Insurance, and sometimes pension contributions. You get a payslip. It shows up as a consistent line item on your bank statement.

An owner’s draw, on the other hand, is money you take out of your business account whenever you need it. No payroll. No withholding. No payslip. You’re just moving money from your business pot into your personal account. It’s not considered income until tax time, when you report your total profits.

Think of it this way: salary is like a steady paycheck from a job. Owner’s draw is like dipping into your savings when you need cash.

Why does this matter for shared ownership?

Shared ownership schemes require you to prove you can afford the mortgage on your share. Lenders look at your income-specifically, your stable, verifiable income. They don’t just want to see profit on paper. They want to see money coming in predictably, month after month.

If you take an owner’s draw, your bank statements might show big deposits one month and nothing the next. Lenders hate that. They see volatility. They see risk. Even if your business is profitable, inconsistent income can make them deny your application-or offer worse rates.

But if you pay yourself a regular salary-even if it’s just £1,500 a month-you give lenders exactly what they want: consistency. Your payslips and bank records line up. Your income looks reliable. That’s the key to getting approved for a shared ownership mortgage.

What about taxes?

Some people think owner’s draws are better because you pay less tax. That’s a myth.

Whether you take a salary or a draw, you still pay tax on your business profits. The difference is when and how it’s calculated.

With a salary, you pay income tax and National Insurance on that salary amount. Your business also pays employer National Insurance on it. But you can deduct the salary as a business expense, which lowers your overall profit-and your tax bill.

With an owner’s draw, you don’t pay anything upfront. But when you file your Self Assessment, you pay income tax and Class 2 and Class 4 National Insurance on your total business profit. No deductions. No withholding. You’re responsible for paying it all at once.

So the total tax owed is usually the same. But the timing and structure are very different.

When should you take a salary?

You should pay yourself a salary if:

- You’re applying for or renewing a shared ownership mortgage

- You need to prove stable income to lenders

- You want to build a credit history tied to regular earnings

- You’re planning to buy more share in your home in the next few years

- You’re eligible for state benefits like Child Benefit or Working Tax Credit, which rely on declared income

Even if your business isn’t making huge profits, paying yourself a modest, consistent salary-say, £1,200 a month-can make a huge difference. It’s not about how much you take. It’s about showing a pattern.

When is an owner’s draw okay?

Owner’s draws make sense if:

- You’re not applying for a mortgage right now

- Your income is highly seasonal (e.g., you run a holiday let business)

- You’re in a startup phase and cash flow is tight

- You’re using the draw to reinvest profits back into the business

But even then, you need to be careful. If you’ve taken large draws over the past 12 months, lenders will still see them as income. They’ll average them out. So if you took £20,000 in draws last year, they’ll treat that as £1,666 per month-even if you didn’t take anything in January.

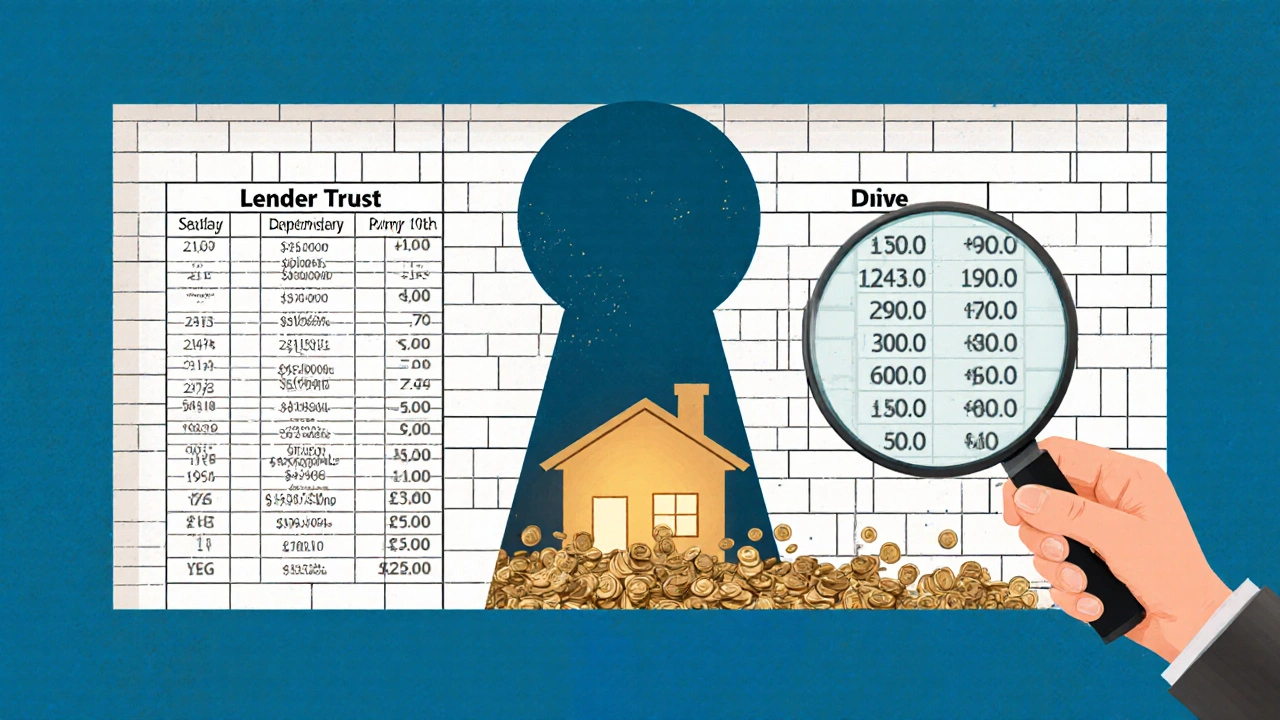

What do lenders actually look at?

Most shared ownership lenders require two years of accounts. They’ll look at:

- Your business profit (from SA302 tax calculations)

- Your salary payments (if any) over the last 12-24 months

- Your bank statements showing consistent transfers to your personal account

They don’t care if you took a £5,000 draw in December. They care if you took £400 every month for the last 18 months.

One real example: Sarah, a freelance graphic designer, owned 50% of a shared ownership flat. She took draws of £3,000-£8,000 per quarter. When she tried to buy another 25% share, her lender declined. Her income looked too erratic. She started paying herself £1,500/month for six months, submitted updated bank statements, and got approved.

What about pensions and benefits?

Paying yourself a salary lets you contribute to a workplace pension. That’s not just for retirement-it can improve your affordability calculations. Lenders often count pension contributions as a reduction in your outgoings.

Owner’s draws don’t trigger automatic pension contributions. You’d have to set up a personal pension separately, which adds complexity.

Also, if you’re claiming benefits like Universal Credit, your income is assessed differently if you’re paid a salary versus taking draws. A salary makes your income easier to track and less likely to trigger sudden benefit cuts.

What’s the best strategy for shared ownership owners?

Here’s what works in practice:

- Set a realistic monthly salary based on your average profit. Don’t overpay-just enough to show stability.

- Pay it on the same day every month. Use payroll software-even free tools like FreeAgent or Zoho Payroll work.

- Keep your business and personal accounts separate. Don’t mix draws and salary.

- Save your owner’s draws for emergencies or business reinvestment, not personal spending.

- Review your salary every 6-12 months as your business grows.

Don’t try to game the system. Lenders and HMRC have tools to spot patterns. If your salary is too low compared to your profits, they’ll question it. If your draws are too high and irregular, they’ll see risk.

What happens if you’ve been taking draws so far?

If you’ve been relying on owner’s draws and now want to buy more of your home, you have options:

- Start paying yourself a salary for at least six months before applying.

- Ask your accountant to prepare a forecast showing consistent future income.

- Provide bank statements showing regular transfers-even if they’re labeled as “draws”-and explain the pattern.

Some lenders will accept a 12-month average of your draws as income. But you’ll need proof: tax returns, bank statements, and a letter from your accountant.

Final tip: Talk to a specialist advisor

Shared ownership lenders aren’t all the same. Some are more flexible than others. A mortgage advisor who specializes in self-employed shared ownership buyers can match you with lenders who understand irregular income patterns.

They’ll know which lenders accept averaged draws, which ones require salary, and how to present your finances in the best light.

Don’t assume the rules are the same as for employed buyers. They’re not. And the difference between a salary and a draw can be the difference between owning more of your home-or being stuck where you are.

Can I take both a salary and owner’s draw?

Yes, you can. Many business owners pay themselves a modest salary to satisfy lenders and then take additional draws for personal use or business reinvestment. But the salary must be consistent and documented. Don’t use draws to cover your salary-it defeats the purpose. The salary should come from business profits, not from your personal funds.

Does taking an owner’s draw affect my credit score?

Not directly. Your credit score is based on loans, repayments, and credit usage-not how you pay yourself. But if your irregular income causes missed payments on bills or credit cards because you didn’t plan ahead, that will hurt your score. A steady salary helps you budget better and avoid this.

Do I need to pay myself minimum wage?

No, you don’t have to pay yourself minimum wage if you’re the owner. But if you’re claiming benefits or applying for a mortgage, lenders often expect your salary to be at least enough to cover basic living costs. A salary of £1,200-£1,500/month is common for shared ownership applicants with small businesses.

Can I change from draws to salary later?

Yes, and you should if you’re planning to buy more of your home. Start the salary at least six months before applying. Keep records of all payments and update your accountant. Lenders want to see a track record-not a last-minute change.

What if my business has a bad year?

If your profit drops, you can reduce your salary-but don’t stop it entirely. Even a small, consistent payment (like £500/month) shows lenders you’re managing your income responsibly. You can explain the dip in your business performance with your accounts and a letter from your accountant. It’s better than showing no income at all.

Choosing between salary and owner’s draw isn’t about which is cheaper. It’s about which gives you control over your future. In shared ownership, stability isn’t optional-it’s the key to moving up the property ladder.