NC Home Advantage Program Calculator

Calculate Your Home Buying Costs

See how much assistance you could get with the NC Home Advantage Program and how much you'll need to bring to closing.

Enter your home price to see your potential assistance

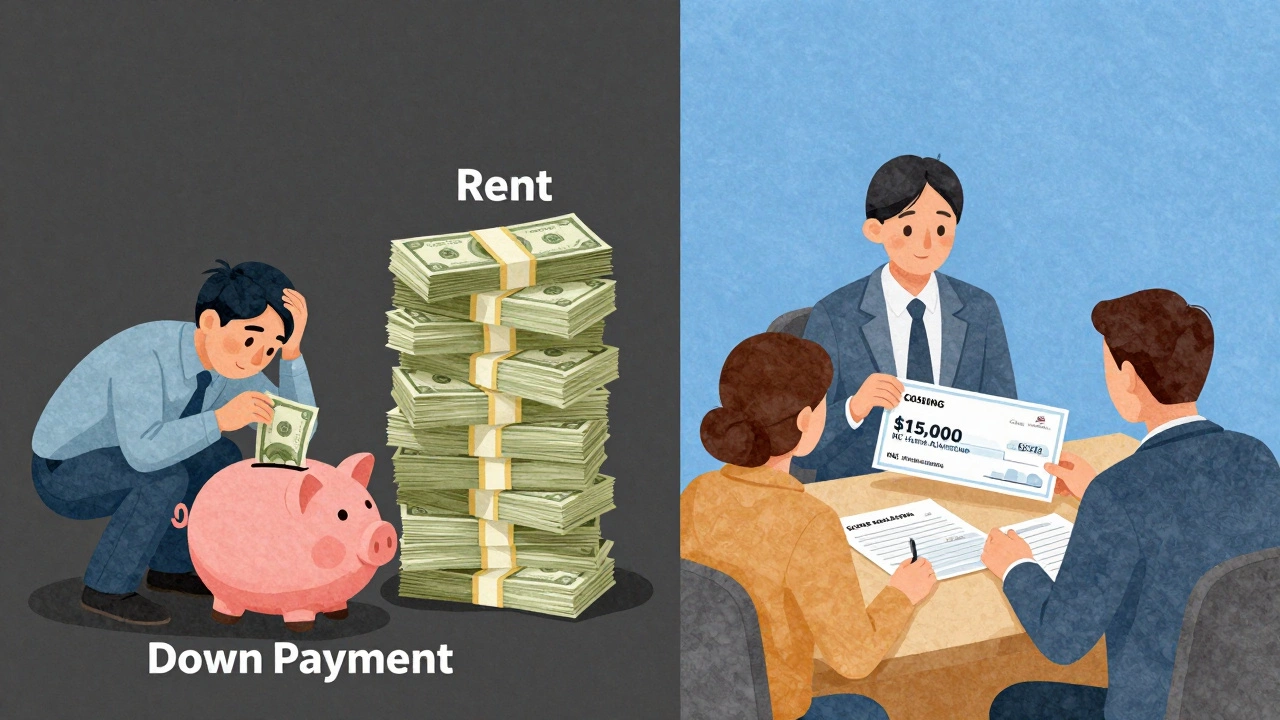

Buying your first home in North Carolina can feel impossible if you’re working with a tight budget. Housing prices have climbed, interest rates are still above 6%, and saving for a down payment feels like running uphill. But there’s a real program that gives eligible first-time buyers up to $15,000 in help - no repayment required. It’s called the NC Home Advantage Program, and it’s not a rumor or a scam. It’s a state-backed mortgage assistance program run by the North Carolina Housing Finance Agency (NCHFA).

How the NC Home Advantage Program Works

The NC Home Advantage Program doesn’t give you cash upfront. Instead, it lowers your monthly mortgage payment by offering a second mortgage that covers part of your down payment and closing costs. The best part? You don’t have to pay it back as long as you live in the home as your primary residence for at least five years. If you move out before then, a portion of the assistance becomes due.

This second mortgage can be up to $15,000 or 5% of the home’s purchase price - whichever is less. That means if you’re buying a $300,000 house, you could get $15,000 in help. If you’re buying a $200,000 home, you’d get $10,000. The program caps the assistance at $15,000, so even if you buy a $500,000 home, you still only get $15,000.

The money is applied directly to your closing costs or down payment. You still need to bring in at least $1,000 of your own money, but that’s it. The rest can be covered by the program. You’ll still need to qualify for a primary mortgage - usually an FHA, VA, USDA, or conventional loan - but the NC Home Advantage Program makes it possible to buy with as little as 3% down.

Who Qualifies?

You don’t need to be a genius with finances to qualify. You just need to meet a few clear rules:

- You must be a first-time homebuyer. That means you haven’t owned a home in the last three years.

- The home must be your primary residence. You can’t use this for vacation homes or investment properties.

- Your household income must be below the program’s limit for your county. In most NC counties, that’s $105,000 for a single person or $125,000 for a household of two or more. In high-cost areas like Wake, Mecklenburg, or Guilford counties, the limit is higher - up to $140,000.

- You must complete a homebuyer education course approved by NCHFA. These are usually online and take about 6-8 hours. Many are free or cost less than $50.

- The home must be a single-family house, townhouse, or condo. Mobile homes and manufactured homes are not eligible.

There’s no credit score minimum set by the program itself, but your lender will likely require at least 620 for FHA loans and 640 for conventional loans. The program is designed to help people who might not qualify otherwise - not people with perfect credit and six-figure incomes.

How Much Can You Save?

Let’s say you’re buying a $250,000 home in Durham. You’ve saved $5,000 for a down payment. With the NC Home Advantage Program, you can get $12,500 in assistance (5% of $250,000). That means you only need to come up with $2,500 of your own money to hit the 3% down requirement. The other $10,000 covers closing costs.

Without this program, you’d need $7,500 just to get into the house. With it, you’re down to $2,500. That’s $5,000 you didn’t have to dig out of your savings - or borrow from your parents.

And here’s the kicker: because your down payment is higher, your monthly mortgage payment is lower. You’ll pay less in private mortgage insurance (PMI), and you’ll build equity faster. Over the life of a 30-year loan, that $15,000 in help can save you more than $40,000 in interest and fees.

How to Apply

Applying isn’t done online through a portal. You have to work with a participating lender. That’s key. Not every bank or mortgage broker offers this program. You need to find one that’s approved by NCHFA.

Here’s the step-by-step:

- Take the NCHFA-approved homebuyer education course. You’ll get a certificate.

- Get pre-approved for a mortgage with a participating lender. Ask them if they offer the NC Home Advantage Program.

- Find a home within the program’s price limits. The maximum purchase price is $550,000 in most counties.

- Submit your application through your lender. They’ll handle the paperwork with NCHFA.

- Close on your home. The $15,000 assistance is wired directly to closing.

It’s not fast - it takes 30 to 45 days from application to closing. But if you’re serious about buying, it’s worth the wait. You can find a list of approved lenders on the NCHFA website. Don’t waste time with lenders who don’t mention this program - they’re not the right fit.

What You Can’t Use It For

It’s easy to get excited and think this program covers everything. It doesn’t. Here’s what it won’t do:

- Help you buy a second home or rental property.

- Pay for renovations or repairs after you move in.

- Cover moving expenses or furniture.

- Be used with a jumbo loan (over $550,000).

- Be combined with other state grants for the same purpose.

Some people try to use it with the USDA loan program or VA benefits. You can’t stack them. But you can use NC Home Advantage with FHA or conventional loans - and that’s where most buyers end up.

Real Stories from Real Buyers

Anna, 29, worked as a nurse in Greensboro. She saved $3,000 over two years. She didn’t think she’d ever own a home. Then she found a $210,000 townhouse. With the NC Home Advantage Program, she got $10,500 in help. She only had to bring $1,500 to closing. She moved in with her cat and a few boxes. Five years later, she’s paid off $18,000 in equity. She says the program didn’t just buy her a house - it bought her peace of mind.

Carlos and Maria, both teachers in Winston-Salem, were renting for seven years. They saved $8,000. They qualified for $15,000 in assistance on a $275,000 home. They got their loan approved in 28 days. Now they have a backyard and a mortgage that’s $300 lower than their old rent.

These aren’t outliers. In 2024, over 5,200 North Carolina families used this program to buy their first home. That’s more than 14 people every day.

Is This Program Going Away?

The NC Home Advantage Program has been around since 2009. It’s funded by federal HOME funds and state bonds. There’s no sign it’s ending. In fact, in 2024, the state increased funding by 12% to keep up with demand. The program is still active as of December 2025.

But funding is limited. Each lender has a cap on how many loans they can close with this assistance each year. If you wait too long, you might miss your chance. Don’t assume it’ll be there next year - apply now.

What Comes After?

Once you’re in your home, you’re not done. You still need to pay your mortgage, property taxes, and insurance. But now you’re building equity instead of paying rent. And after five years, you can sell, refinance, or even rent out the home - without paying back the $15,000.

If you stay in the home long-term, the program becomes a silent advantage. You’ve lowered your monthly costs, reduced your debt load, and locked in a fixed rate. In a market where prices keep rising, that’s the real win.

This isn’t handout money. It’s a tool - designed to help working people who are ready to buy but just need a little push. If you’ve been waiting to get into the housing market, this is your chance. Don’t wait for the perfect time. The perfect time is now - with the NC Home Advantage Program.

Can I use the NC Home Advantage Program with a VA loan?

No, you cannot combine the NC Home Advantage Program with a VA loan. The program only works with FHA, USDA, and conventional mortgages. VA loans already offer 0% down payments, so the state doesn’t allow stacking benefits. But if you’re a veteran and don’t qualify for a VA loan due to credit or income, you can still use the NC Home Advantage Program with a conventional loan.

Do I have to pay back the $15,000?

No, you don’t have to pay it back as long as you live in the home as your primary residence for at least five years. If you sell, refinance, or move out before then, a portion of the assistance becomes due. The repayment amount is prorated - for example, if you leave after three years, you’ll repay 40% of the assistance. The NCHFA handles this automatically during the sale or refinance process.

Can I use this program if I’ve owned a home before?

Only if you haven’t owned a home in the last three years. The program defines a first-time buyer as someone who hasn’t held title to a primary residence in the past 36 months. So if you owned a home five years ago and have been renting since, you’re eligible. But if you sold a home last year, you’re not.

What if my income is just over the limit?

If your household income exceeds the limit by even $1, you won’t qualify. The limits are strict and based on your gross income before taxes. There are no exceptions. But if you’re close, consider waiting a few months to reduce your income (like taking unpaid leave) or applying as a single applicant instead of a household. Some counties have higher limits - check NCHFA’s income chart for your specific county.

Is the $15,000 a grant or a loan?

It’s technically a deferred second mortgage - not a grant. But because you don’t make monthly payments and don’t pay interest, it functions like a grant. You only repay if you leave the home before five years. For most buyers who plan to stay, it’s effectively free money.