North Carolina First-Time Home Buyer Eligibility Calculator

Qualification Assessment

Enter your financial details below to see if you qualify for North Carolina's first-time home buyer programs.

If you’re a first-time home buyer NC dreaming of a place to call your own, the biggest question on your mind is probably: "Do I qualify?" North Carolina offers a mix of state programs, federal options, and strict lender rules that can feel overwhelming. This guide breaks down every eligibility piece, walks you through the exact steps to prove you’re ready, and even compares the most common loan programs so you can pick the best fit.

What "First‑Time" Really Means in North Carolina

In the Tar Heel State, the term isn’t just a label-it determines which assistance you can tap. The North Carolina First-Time Home Buyer Qualification defines a first‑time buyer as anyone who has not owned a principal residence within the past three years, or who is buying a home for the first time ever. If you owned a home two years ago, you’ll need to wait until the three‑year window closes before you can claim first‑time status for state‑run programs.

Core Eligibility Pillars

- Credit Score A numeric representation of your creditworthiness, typically ranging from 300 to 850. Most programs require at least 580 for FHA, 620 for conventional, and 640 for North Carolina’s own Home Advantage loan.

- Debt‑to‑Income Ratio (DTI) The percentage of your monthly gross income that goes toward debt payments. Lenders usually cap DTI at 45 % for qualified buyers.

- Stable Employment A reliable job history of at least two years, or a steady source of self‑employment income. Gaps can be offset by a co‑borrower with a stronger record.

- Residency Status - You must be a U.S. citizen, permanent resident, or have a valid work visa.

- Income Limits - Some state programs cap household income based on county median income. For example, the NCHFA Home Advantage program limits income to 120 % of the area median.

North Carolina‑Specific Assistance Programs

The state’s housing agency, North Carolina Housing Finance Agency (NCHFA) A public‑private partnership that provides affordable home‑ownership solutions to eligible North Carolinians., runs two flagship options you’ll hear about most often.

- Home Advantage Mortgage - A low‑interest, fixed‑rate loan with down‑payment options as low as 3 % for qualified buyers.

- Down Payment Assistance (DPA) - A grant or low‑interest loan covering up to 5 % of the purchase price, repayable only when you sell or refinance.

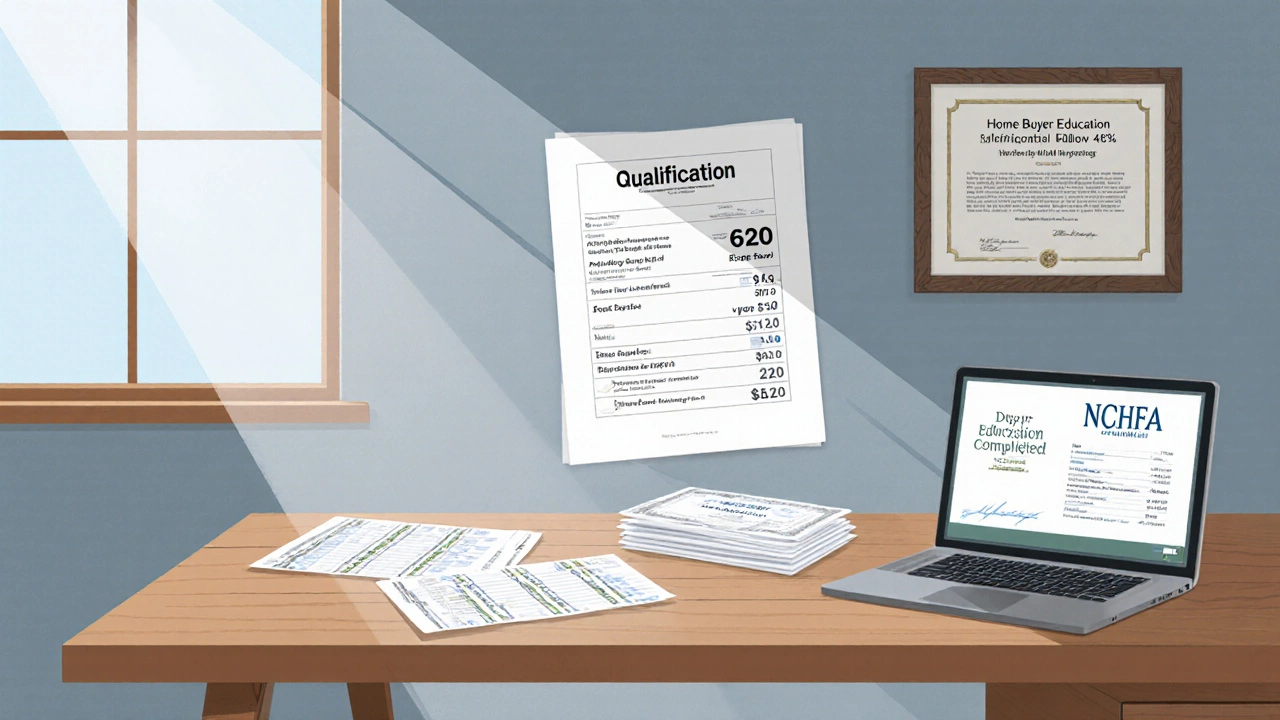

Both require you to complete a home‑buyer education course approved by NCHFA, usually a four‑hour online class.

Step‑by‑Step Qualification Process

- Verify First‑Time Status - Confirm you haven’t owned a primary residence in the last three years. If you’re unsure, pull a property ownership report from the county clerk.

- Check Your Credit - Pull your free annual credit report (annualcreditreport.com). Aim for the minimum score required by your chosen program.

- Calculate Debt‑to‑Income - Add up all monthly debt payments (car loans, student loans, credit‑card minimums) and divide by gross monthly income. Stay below 45 %.

- Gather Income Documentation - Recent pay stubs, W‑2s, or profit‑and‑loss statements if self‑employed. Lenders will also ask for two years of tax returns.

- Complete a Home‑Buyer Course - Register for the NCHFA approved class. You’ll receive a certificate that you’ll attach to your loan application.

- Get Mortgage Pre‑Approval - Approach a lender that participates in NCHFA programs. Provide the documents above and the pre‑approval letter will outline how much you can borrow.

- Identify Eligible Property - The home must be a primary residence, located in North Carolina, and fall within the loan amount limits (e.g., $650,000 in most counties).

- Apply for Down‑Payment Assistance - Submit the DPA application alongside your mortgage paperwork. If approved, the assistance funds will be earmarked for closing.

Following these steps in order keeps the process smooth and reduces the chance of a surprise denial at the closing table.

Program Comparison: Which Loan Fits Your Situation?

| Program | Minimum Credit Score | Down‑Payment Required | Income Limits | Maximum Loan Amount | Typical Interest Rate (2025) |

|---|---|---|---|---|---|

| NCHFA Home Advantage | 640 | 3 % (as low as 3 % with DPA) | 120 % of county median income | $650,000 (varies by county) | 4.75 % fixed |

| FHA Loan | 580 | 3.5 % | No explicit limit (must meet loan caps) | $1,089,300 (2025 FHA loan limit for most of NC) | 5.15 % fixed |

| Conventional Loan | 620 | 5 % (with private mortgage insurance) | None (but higher income improves approval odds) | $970,000 (conforming loan limit) | 4.90 % fixed |

Notice how the NCHFA option trades a modest credit‑score floor for income caps and a lower maximum loan amount. If your income sits near the state median and you qualify for DPA, that program often wins on total out‑of‑pocket cost.

Common Pitfalls and Pro Tips

- Skipping the Home‑Buyer Course - Most lenders will reject your application without the certificate, even if you meet every other criterion.

- Overlooking Property Eligibility - Some historic districts or new‑construction projects don’t qualify for NCHFA assistance.

- Assuming Your Credit Is Fixed - Small actions (paying down a credit‑card balance, clearing a collections entry) can boost your score by 30 points in a month.

- Ignoring Closing Cost Estimates - Budget an extra 2‑5 % of the purchase price for fees, escrow, and insurance.

- Relying on a Single Lender - Shop around; NCHFA works with a network of approved lenders, and rates can vary by as much as 0.25 %.

By planning for these hiccups ahead of time, you’ll keep the momentum going and avoid costly delays.

Pre‑Application Checklist

- Proof of first‑time status (no home ownership in past 3 years)

- Recent credit report showing required score

- Debt‑to‑Income calculation below 45 %

- Two years of pay stubs, W‑2s, or tax returns

- Certificate of completion from an NCHFA‑approved home‑buyer class

- Pre‑approval letter from an approved lender

- List of potential properties that meet program guidelines

- Down‑payment source documentation (savings statements, DPA grant approval)

Check each box before you start the formal loan application; missing items are the most common reason lenders pause the file.

Frequently Asked Questions

Do I need a 20 % down payment to qualify for any NC program?

No. The NCHFA Home Advantage loan accepts as little as 3 % down, and the Down Payment Assistance grant can cover up to another 5 %.

Can I use a gift from family for the down payment?

Yes, as long as the donor provides a signed gift letter stating the money is not a loan and that they won’t expect repayment.

What if I have student loan debt?

Student loans count toward your DTI. Keep total monthly debt payments (including student loans) below 45 % of gross income to stay eligible.

Do I have to live in the home for a certain period?

Most NC assistance programs require you to occupy the home as your primary residence for at least 12 months.

Is there a deadline to apply for the NCHFA DPA?

Funding is allocated annually and can run out quickly. It’s best to apply as soon as you have a signed purchase contract and a pre‑approval.

Armed with these answers, you can move forward with confidence. Remember, the key is preparation: know your numbers, finish the education course, and partner with a lender familiar with North Carolina’s first‑time buyer incentives. Soon enough you’ll be unlocking the front door of your very own Carolina home.