Monthly Dividends: What They Are and How They Work for Property Investors

When you hear monthly dividends, regular payments made to investors from income-generating assets like rental properties. Also known as rental income, it’s not magic—it’s the money that flows in each month after expenses are paid. For many, this is the whole reason they buy property: to get paid regularly without trading time for money.

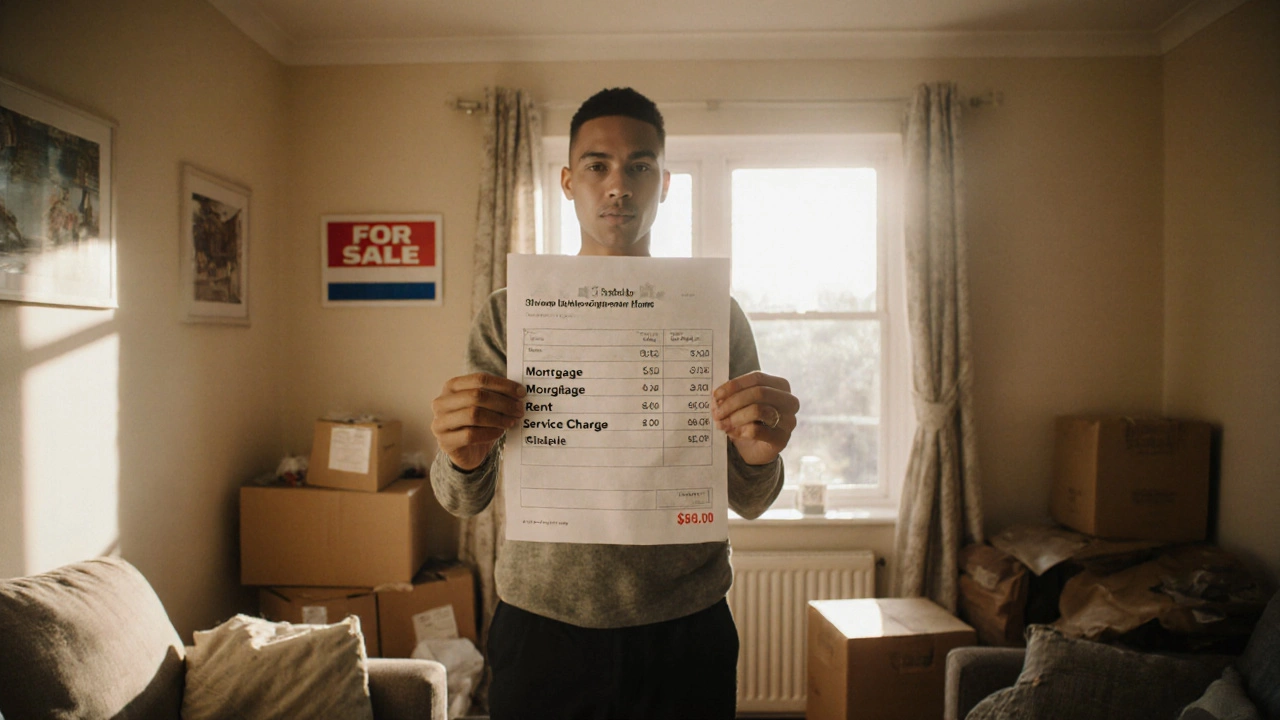

Monthly dividends in real estate come from renting out homes. You buy a property, find a tenant, collect rent, pay the bills—mortgage, insurance, repairs—and whatever’s left? That’s your dividend. It’s not the same as stock dividends, but the idea is similar: you own something that earns you cash on a schedule. And unlike stocks, you can see, touch, and improve your asset. A better kitchen or a new roof doesn’t just make your tenant happy—it boosts your monthly payout.

Not every property delivers strong monthly dividends. Location matters. A cheap house in a bad area might sit empty for months. A well-located rental, even if it costs more upfront, can pay you back faster. That’s why investors look at rental income, the total cash collected from tenants before expenses. Also known as gross rent, it’s the starting point for figuring out real returns. Then there’s property investment, the strategy of buying real estate to generate ongoing income and long-term value. Also known as buy-to-let, it’s how thousands of people in the UK build wealth without working 60-hour weeks. You don’t need to own a penthouse or a mansion apartment to make this work. Even a modest two-bedroom flat in a decent town can deliver solid monthly dividends if managed right.

Some people think you need a huge down payment to start. Not true. Many investors begin with shared ownership, where you buy a portion of the home and pay rent on the rest. Over time, you can increase your share until you own 100%. That’s still a property investment—and it still generates monthly dividends, even if they’re smaller at first. And if you’re worried about pets, bad tenants, or repairs? The posts below show real ways to handle those problems before they cost you money.

You’ll find guides here on how much house you can afford on different salaries, what credit score you really need, and how landlords decide whether to accept pets. There’s no guesswork. Just clear, practical info from people who’ve been there. Whether you’re looking to start small or scale up, the monthly dividends you earn from property can change your financial future—without needing a finance degree.