Premium Property: What Defines the High-End Market

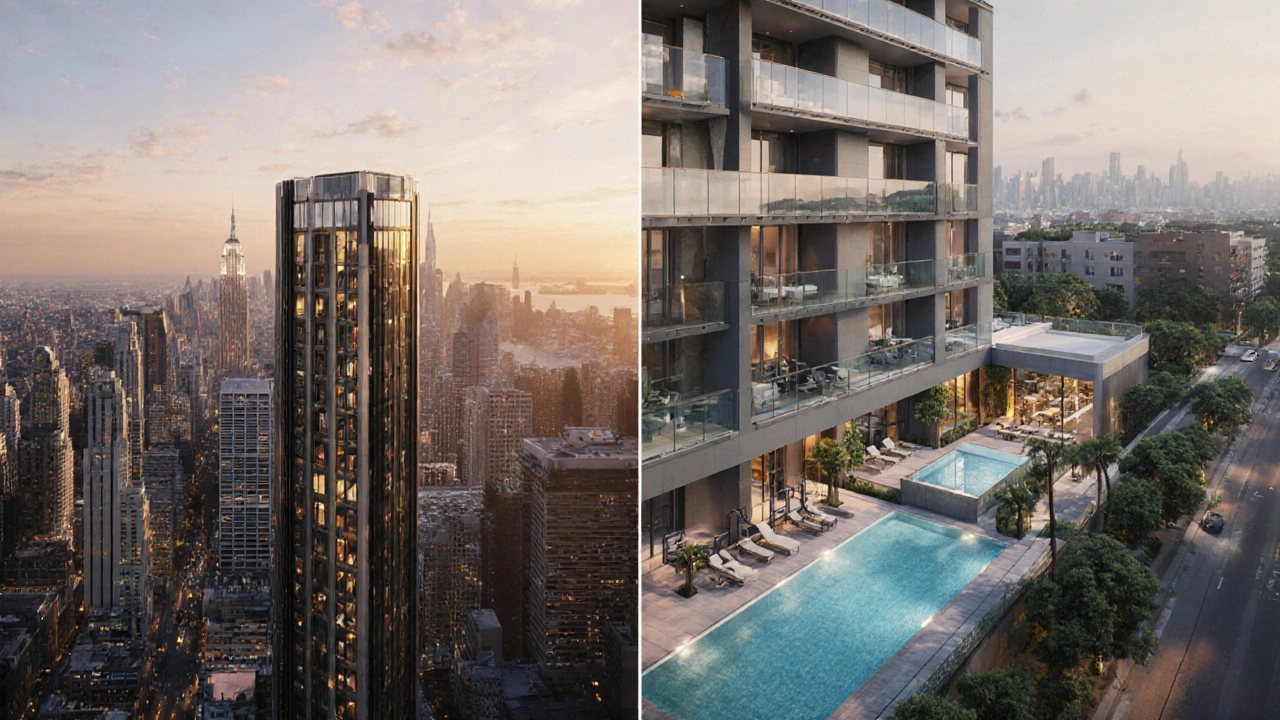

When talking about premium property, a real estate asset that offers top‑tier finishes, prime locations and exclusive amenities. Also known as luxury home, it sets the benchmark for quality and status. In today’s market, premium property stands out because buyers expect both opulence and long‑term value. Luxury living covers high‑end design, concierge services and premium neighbourhood perks often drives the price of a premium property. Think penthouses with private elevators, waterfront villas with dock access, or historic manors with original mouldings – each feature adds a layer of prestige that pushes the price curve upward. Location is another driver; properties perched on city centre squares, scenic golf courses, or secluded countryside estates enjoy a built‑in demand premium. Co‑ownership structures like joint tenancy or shared equity let multiple investors hold a slice of a premium asset can make such homes more accessible while preserving exclusivity, letting families or friends pool resources for a dream address. Meanwhile, property investment focuses on capital growth, rental yield and portfolio diversification treats premium properties as high‑return vehicles, especially when market demand spikes or when scarcity drives price appreciation. Finally, selecting a specialist estate agent who knows high‑value listings helps buyers negotiate terms, verify titles and unlock financing options is crucial for a smooth purchase. These five pieces fit together to shape how premium property is defined, bought and profited from.

Key Factors Shaping the Premium Property Landscape

Premium property encompasses luxury living, which influences buyer expectations and sets price floors. It requires solid financing, often a high credit score and sizable down payment, so lenders scrutinize income stability and debt‑to‑income ratios. Mortgage products for high‑value homes frequently include interest‑only periods or bespoke loan‑to‑value calculations, and borrowers may need to factor in higher stamp duty or council tax rates. Luxury living also boosts property investment appeal, because high‑end homes tend to retain value during market dips and can command premium rental yields in affluent neighborhoods. Co‑ownership offers an alternative route, letting investors split costs while still enjoying the prestige of a premium address, but it demands clear legal agreements to avoid disputes over maintenance responsibilities and exit strategies. Estate agents with a luxury focus bring market intel that can uncover off‑market deals, giving buyers an edge; they also coordinate with appraisers who understand the added value of bespoke finishes and exclusive amenities. Tax considerations play a part too – capital gains tax thresholds, inheritance tax planning, and possible reliefs for primary residences can affect the overall profitability of a premium purchase. Insurance premiums are higher for high‑value assets, especially when they include valuable contents or unique structural features, so buyers should compare specialist policies. Finally, market cycles matter: a surge in foreign investment or a new transport link can instantly lift demand, while economic uncertainty might tighten credit and slow sales. Understanding how these elements interact helps buyers and investors make informed decisions rather than chasing hype.

Below you’ll find a curated selection of articles that dig into each of these angles – from co‑ownership structures and financing tips to what makes a luxury condo different from a standard apartment. Whether you’re eyeing your first high‑end purchase, looking to split ownership with a partner, or fine‑tuning an investment portfolio, the guides ahead break down the jargon, reveal hidden costs and arm you with actionable steps. Dive in and discover how to navigate the premium property world with confidence.