Luxury vs Premium Home Decision Guide

Luxury Property

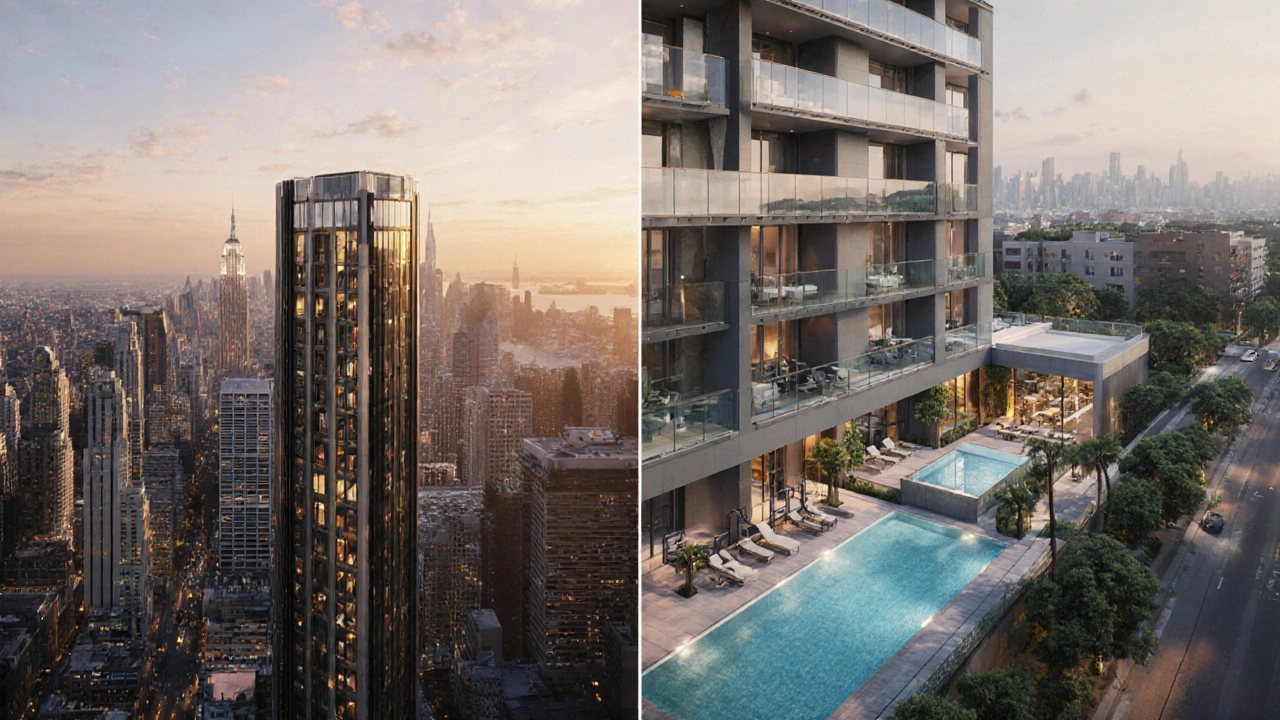

High-end real estate with exceptional design, rare materials, and exclusive amenities. Targets affluent buyers seeking status and unique living experiences.

Premium Property

Well-finished homes with high-quality finishes and modern amenities. Appeals to buyers wanting comfort and quality without ultra-high prices.

Key Decision Factors

Recommended Property Type

Financial Comparison

When you start hunting for a high‑end home, the first question that pops up is often: luxury vs premium. Both sound upscale, but they carry different expectations, price tags, and long‑term implications. This guide breaks down the two labels, lines up the key factors you should weigh, and helps you decide which vibe fits your lifestyle and budget.

Key Takeaways

- Luxury properties focus on exclusivity, unique design, and top‑tier amenities; premium homes offer high quality without the ultra‑exclusive flair.

- Luxury typically commands higher purchase price, ongoing maintenance, and a narrower buyer pool.

- Premium homes often deliver better resale liquidity and lower holding costs while still providing a comfortable, high‑standard living experience.

- Location, intended use (primary residence vs investment), and personal priorities determine which label is the smarter pick.

Luxury property is a high‑end real‑estate offering exceptional design, rare materials, and a suite of exclusive services such as concierge, private pools, and on‑site staff. It targets affluent buyers seeking status and a one‑of‑a‑kind living environment.

Premium property is a well‑finished home that sits at the top of the standard market tier, featuring high‑quality finishes, modern appliances, and desirable locations, but without the ultra‑exclusive extras of luxury. It appeals to buyers who want comfort and quality without the ultra‑high price.

What Sets Luxury Apart from Premium?

Both categories sit above the average market, yet the gap lies in three core dimensions: exclusivity, amenities, and price elasticity.

Exclusivity

Luxury developments often limit unit numbers to preserve privacy-think a five‑unit villa complex or a single‑building penthouse tower. Premium projects are larger, with dozens or even hundreds of units, which means more competition but also easier resale.

Amenities

Luxury Amenities can include private elevators, roof‑top helipads, art‑curated common areas, and full‑time concierge. Premium Amenities usually cover gym, pool, and secure parking-great, but not world‑class.

Price Elasticity

Luxury prices are less sensitive to market swings because they serve a niche of wealthier buyers. Premium homes track the broader market more closely, meaning they can appreciate faster in a booming economy but also dip quicker during downturns.

Decision Criteria Checklist

- Budget ceiling: Do you have the cash to cover a purchase price plus higher ongoing costs?

- Desired lifestyle: Is a concierge service or private garden a must?

- Resale strategy: Will you hold the property long term or flip it?

- Location priorities: Do you need a prime city address (often premium) or a secluded enclave (often luxury)?

- Maintenance tolerance: Luxury homes can demand specialist upkeep-are you ready for that?

Side‑by‑Side Comparison

| Feature | Luxury Property | Premium Property |

|---|---|---|

| Typical Price Range (NZD) | $5million-$20million+ | $1million-$5million |

| Unit Count per Development | 1-10 units | 20-200+ units |

| Design Exclusivity | Architect‑designed, bespoke finishes | High‑grade, but standardized |

| Amenities | Private elevators, concierge, spa, helipad | Gym, pool, secure parking |

| Target Buyer | High‑net‑worth individuals, investors seeking prestige | Affluent families, professionals, investors looking for growth |

| Maintenance Costs | 15%-20% of property value annually (specialist services) | 5%-8% of property value annually |

| Resale Liquidity | Longer sell cycles, niche buyer pool | Faster turnover, broader market appeal |

| Investment Return Potential | Stable appreciation, limited rental yields | Higher rental yields, potentially higher short‑term gains |

Best Fit Scenarios

Choose Luxury if…

- You value exclusivity above all-private lifts, gated entrances, and a limited neighbour count matter to you.

- Your primary goal is status signaling rather than rental income.

- You have a long‑term horizon and can absorb higher maintenance fees without stressing cash flow.

Choose Premium if…

- You want high quality without the ultra‑premium price tag.

- You plan to rent the unit out and need strong rental yields.

- You prefer quicker resale and broader buyer interest.

Financial Implications

Let’s break down the numbers with a simple example from Auckland’s waterfront market (2024‑2025 data).

- Luxury condo: Purchase price $12million, annual property tax ~1.5% ($180k), specialist maintenance $240k, expected annual appreciation 4%.

- Premium apartment: Purchase price $3million, tax $45k, maintenance $150k, expected appreciation 6% plus average rental yield 5%.

Running the math over a five‑year hold:

- Luxury total cost (price + taxes + maintenance) ≈ $15.6million; projected value ≈ $14.6million (appreciation only). Net loss before taxes.

- Premium total cost ≈ $4.2million; projected value ≈ $4.5million plus rental income ≈ $750k. Net gain around $1million.

These figures illustrate why premium can outperform luxury for investors, while luxury excels for those who aren’t chasing cash flow but want a statement piece.

Common Pitfalls to Avoid

- Over‑focusing on brand names. A well‑known luxury developer doesn’t guarantee future appreciation.

- Ignoring hidden costs. Service fees, specialist landscaping, and insurance for high‑value assets can erode returns.

- Misreading market cycles. Buying luxury at a peak can lock you into a prolonged dip.

How to Evaluate a Property Correctly

Use this quick audit when touring any high‑end home:

- Check provenance. Verify the developer’s track record and any past legal issues.

- Assess the Location. Proximity to transport, schools, and future infrastructure projects.

- Quantify the Investment return. Request historical appreciation data and rental comps.

- Calculate the Maintenance cost ratio. Ask for the last three years of service charge statements.

- Match the Target buyer profile. Does the property fit your personal or investment persona?

Next Steps for Buyers

If you’ve landed on a property that feels right, follow this roadmap:

- Engage a specialised real‑estate solicitor (the Legal team) to review contracts and any covenants.

- Secure financing that aligns with the cash‑flow demands-premium properties often qualify for standard mortgages, luxury may need tailored finance.

- Commission a professional valuation to confirm market price and future upside.

- Run a personal cash‑flow model that includes tax, insurance, and maintenance.

- Make an informed offer based on the audit and your strategic goals.

Conclusion

Luxury and premium each have a distinct sweet spot. Luxury shines when exclusivity, bespoke design, and status are paramount. Premium wins when you need high quality, better liquidity, and stronger returns. Pinpoint which factors matter most to you, run the numbers, and let the data guide the decision.

Frequently Asked Questions

Is a luxury property always more expensive than a premium one?

Generally yes. Luxury homes target the ultra‑high‑net‑worth segment and often feature unique architecture, limited units, and premium services that push prices well above premium offerings. However, location can blur the lines-a prime‑location premium apartment might cost as much as a modest luxury villa in a less‐desirable area.

Do luxury properties have better resale value?

Not necessarily. Luxury properties tend to appreciate steadily, but the buyer pool is smaller, which can lengthen the selling period. Premium homes often sell faster because they appeal to a broader market, and in a strong economy they can surpass luxury appreciation rates.

Which type offers better rental yields?

Premium properties usually deliver higher yields. Their rent‑to‑price ratios are healthier because they’re priced lower relative to the rental market. Luxury homes can command premium rents, but the high purchase price often offsets the advantage.

What hidden costs should I expect with a luxury home?

Expect higher service charges for concierge, security, and specialised maintenance (e.g., pool chemistry, art preservation). Insurance premiums are also steeper due to higher rebuild values. Don’t forget property taxes, which are calculated on a higher assessed value.

Can I finance a luxury property with a standard mortgage?

Standard banks may be hesitant for ultra‑high‑value homes. You’ll often need a specialised lender, a larger deposit (30‑40%), and possibly a higher interest rate. Premium properties usually qualify for conventional financing.