Zestimate Accuracy Calculator

How Accurate is Your Zestimate?

Enter your home details to see how reliable Zillow's estimate might be for your property. Based on data from the National Association of Realtors and Zillow's own disclosures.

Your Zestimate Accuracy Score

When you type your address into Zillow, it spits out a number-sometimes within a few thousand dollars of what you think your home is worth. It feels like magic. But is it reliable? If you’re thinking of selling, refinancing, or just curious about your home’s value, you need to know what that number really means-and when to ignore it.

How Zillow’s Estimate Works

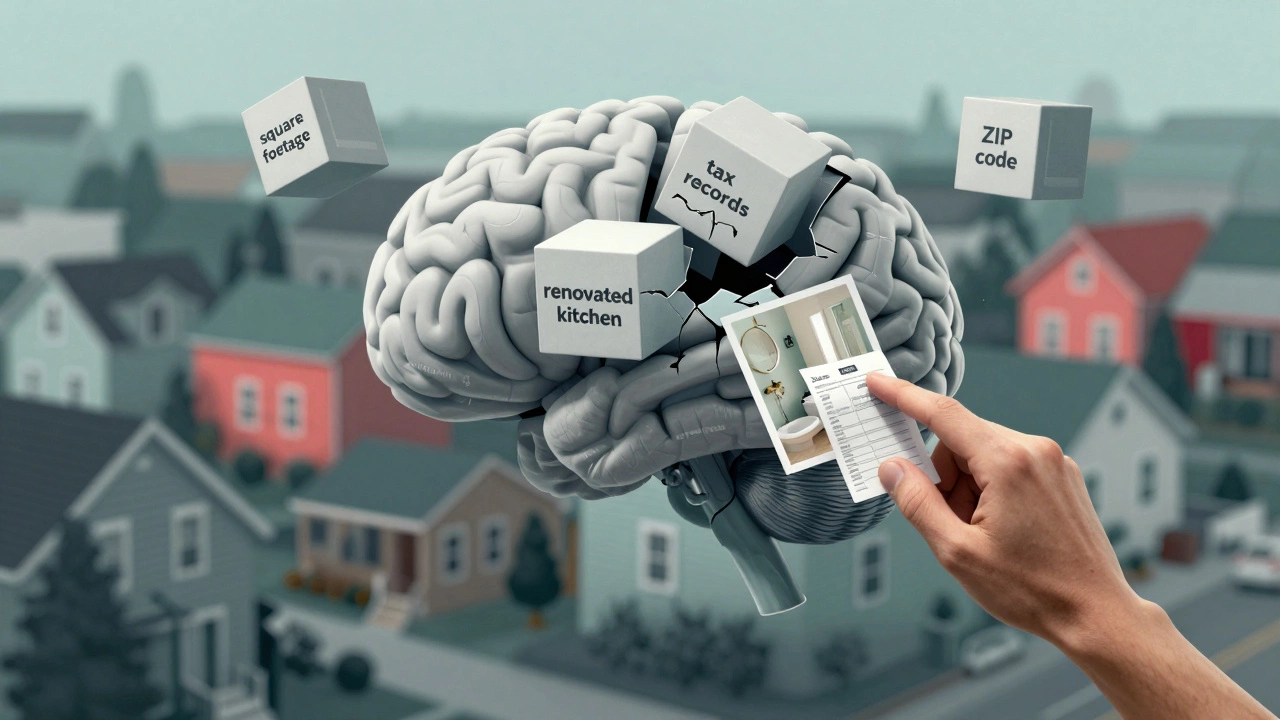

Zillow’s estimate, called a Zestimate, isn’t an appraisal. It’s an algorithm. It scans public records-square footage, number of bedrooms, recent sales in your neighborhood, tax assessments-and throws them into a model trained on millions of past transactions. It doesn’t send someone to your front door. It doesn’t see your renovated kitchen or the cracked foundation in the basement. It doesn’t know if your backyard floods every winter or if your street just got a new bike path.

In places with lots of recent sales and clean data-like Seattle or Austin-Zestimates tend to be closer to reality. In areas with sparse data, older homes, or unusual layouts? They can be way off. A 2023 study by the National Association of Realtors found Zestimates were within 5% of the final sale price in only 47% of cases. That means more than half the time, the number is off by more than $20,000 on a $400,000 home.

Why Zestimates Get It Wrong

Here are the top five reasons your Zestimate might be misleading:

- Outdated or missing data: If your home was renovated in 2022 but the county records still show it as a 1980s box with no upgrades, Zillow has no way of knowing. Many rural counties update records once every few years-or never.

- Unique features ignored: A home with a solar array, a finished basement, or a detached studio might be worth more. Zillow doesn’t value those unless they’re in the public record.

- Neighborhood boundaries are fuzzy: Zillow uses ZIP codes and tax districts to group homes. But a house on one side of the street might be in a better school zone than the one next door-and Zillow treats them the same.

- Market swings move too fast: If home prices jumped 15% in your area last year, Zillow’s algorithm might still be using data from six months ago. Real estate moves faster than data pipelines.

- No human intuition: A well-maintained home with great curb appeal might sell for more than its square footage suggests. Zillow can’t smell the fresh paint or feel the light in the living room.

When Zestimates Are Actually Useful

Don’t throw Zillow out entirely. It’s a decent starting point-if you know how to use it.

For example, if you’re comparing three homes in the same neighborhood, Zestimates can help you spot outliers. If one home is listed at $450,000 but Zillow says it’s worth $380,000, that’s a red flag. Maybe the listing is overpriced. Or maybe the home has serious issues the seller isn’t disclosing.

Zillow is also helpful for tracking trends. If your Zestimate jumped $50,000 in six months while your neighbors’ stayed flat, you might want to ask why. Is your area seeing new development? Are investors buying up homes? That’s useful intel-even if the exact number isn’t perfect.

What’s a Better Way to Value Your Home?

If you’re serious about knowing your home’s real value, you need more than an algorithm.

Get a professional appraisal. A licensed appraiser visits your home, takes photos, measures rooms, checks the condition of the roof, HVAC, plumbing, and compares your property to three to five recently sold homes that are truly comparable. This costs $400-$700, but it’s the gold standard for lenders and legal purposes.

Ask a local real estate agent for a CMA. A Comparative Market Analysis isn’t an official appraisal, but it’s far more accurate than Zillow. A good agent pulls data from the local MLS-multiple listing service-which includes sold prices, days on market, and details Zillow doesn’t have access to. They’ll also tell you what buyers are actually offering right now, not what a computer thinks they should offer.

Check local government tax assessments. These aren’t market values, but they’re public and updated annually. If your tax assessment is $300,000 and Zillow says $420,000, there’s a big gap. That doesn’t mean Zillow’s right-it might mean the tax office is behind.

Real-World Example: A Home in Auckland

In 2024, a house in Mt. Roskill, Auckland, listed for $950,000. Zillow estimated it at $810,000. The seller thought Zillow was too low. The buyer thought it was too high. They hired a local agent who pulled MLS data from five similar homes sold in the past 90 days. All five sold between $890,000 and $930,000. The house sold for $925,000-$115,000 above Zillow’s estimate.

Why? The house had a recently installed heat pump, a renovated bathroom, and was in a quiet cul-de-sac-details not in public records. The Zestimate missed all of it.

How to Improve Your Zestimate

You can’t control the algorithm-but you can feed it better data.

- Go to Zillow and claim your home.

- Update the square footage, number of bedrooms, bathrooms, and any major upgrades (new roof, solar panels, finished basement).

- Add photos of renovations.

- Submit recent sale receipts for improvements-like a kitchen remodel invoice.

It won’t fix everything, but it can nudge the estimate closer to reality. One homeowner in Wellington updated their Zillow profile after installing a new kitchen and saw their Zestimate jump by $65,000 in two weeks.

The Bottom Line

Zillow’s estimate is a rough draft-not the final version. It’s useful for quick context, but never for making financial decisions. If you’re selling, refinancing, or buying, treat it like a weather forecast: it gives you a general idea, but you still need to check the sky yourself.

Real estate value isn’t a number on a screen. It’s what a buyer is willing to pay right now, in your neighborhood, for your home’s condition, location, and curb appeal. That’s something no algorithm can fully capture.

Are Zillow estimates legally binding?

No, Zillow estimates are not legally binding. They’re automated guesses and cannot be used for mortgages, tax appeals, or legal disputes. Only a licensed appraiser’s report holds legal weight in real estate transactions.

Why is my Zestimate lower than my neighbor’s?

Even identical homes can have different Zestimates because of tiny differences in data. Maybe your neighbor’s home was sold recently and the sale was recorded, but yours wasn’t. Or maybe your home’s square footage is listed as 1,800 sq ft in public records, but it’s actually 2,100 sq ft. Zillow uses whatever data it has-even if it’s wrong.

Can I trust Zillow if I’m buying a home?

Use Zillow to get a general sense of market prices, but never rely on it to decide how much to offer. Always work with a local agent who can show you recent comparable sales from the MLS. Zillow doesn’t know if a home was sold in a divorce, by an estate, or as a short sale-those affect price.

How often does Zillow update its estimates?

Zillow updates Zestimates daily, but only if new public data becomes available. If no new sales or property records are added to the system in your area, your estimate might stay the same for months-even if the market has shifted.

Do banks accept Zillow estimates for mortgages?

No. All lenders require a licensed appraiser to assess the property’s value before approving a mortgage. Zillow estimates are not accepted by any bank or mortgage company in the U.S., Canada, Australia, or New Zealand.

Next Steps if You’re Thinking of Selling

If you’re considering selling your home, here’s what to do next:

- Claim your home on Zillow and update the details-this takes five minutes.

- Call two local real estate agents and ask for a free Comparative Market Analysis (CMA).

- Compare the two CMAs. If they’re within 5% of each other, you’ve got a solid range.

- Don’t pick the agent who gives you the highest number-pick the one who explains the market best.

- Use Zillow to monitor trends, but never to set your price.

The goal isn’t to make Zillow right. It’s to make sure you’re not fooled by it.