Shared Ownership Cost Calculator

Calculate Your Shared Ownership Costs

See how much you'd pay monthly for shared ownership based on your property value and share percentage.

If you’ve ever looked at a home price and felt like you’re being priced out of the market, shared ownership might be the quiet solution you haven’t heard enough about. It’s not a loan, not a gift, and not a rental. It’s something in between - a way to own a piece of your home without needing to buy the whole thing upfront.

How Shared Ownership Actually Works

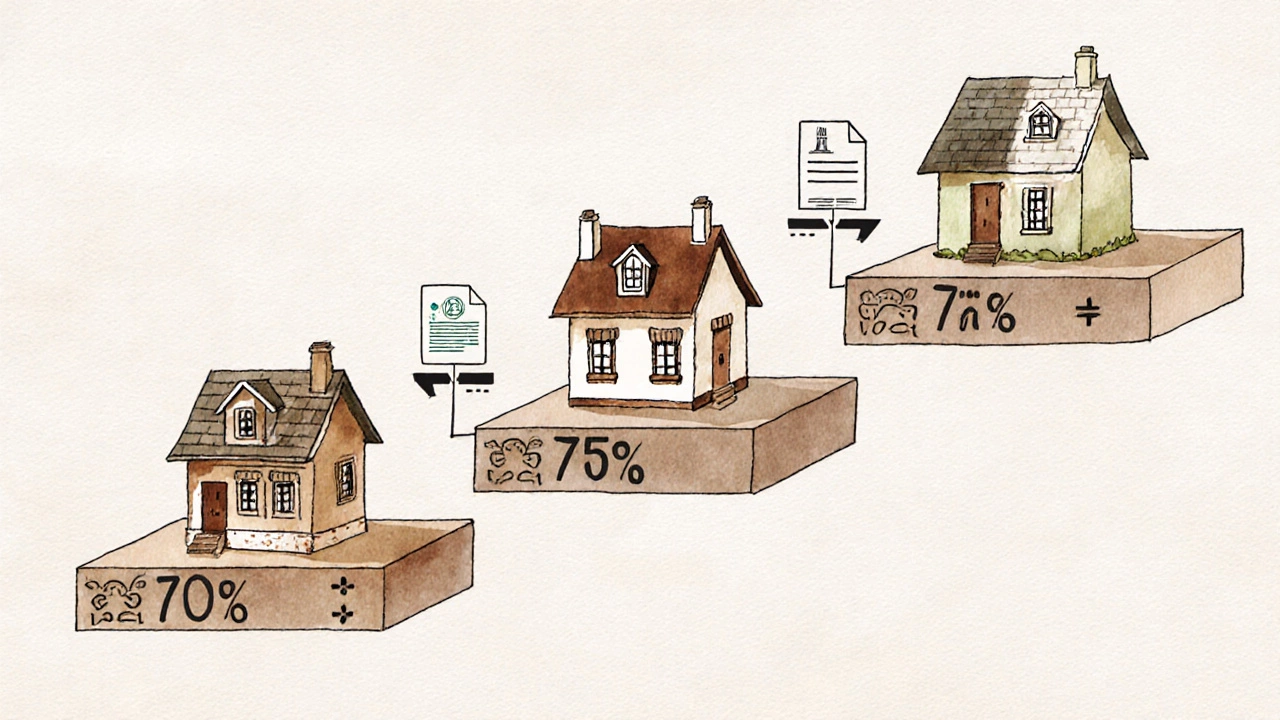

Shared ownership lets you buy a portion of a home - usually between 25% and 75% - while paying rent on the rest. The remaining share is owned by a housing association or a public body like a local council. You take out a mortgage for the part you’re buying, and you pay monthly rent on the part you’re not. Over time, you can buy more shares until you own 100% - this is called staircasing.

For example, if a home is worth £300,000 and you buy a 50% share, you pay £150,000 upfront. You get a mortgage for that amount, and you pay rent on the other £150,000 to the housing association. That rent is typically around 2.75% of the unsold share per year, so in this case, you’d pay about £344 a month in rent. Your total monthly cost? Mortgage payment + rent + service charge. It’s often cheaper than renting the same property outright.

Who Qualifies for Shared Ownership?

You don’t need to be a first-time buyer, but most schemes prioritize people who haven’t owned a home before. Your household income must be under £80,000 in most parts of England (or £90,000 in London). You can’t own another property when you apply. If you’re divorced or separated, you may still qualify if your ex-partner keeps the other home.

Some schemes allow people with disabilities, veterans, or those working in key public services like nursing or teaching to get priority. You’ll need a good credit history and enough savings for a deposit - usually 5% to 10% of the share you’re buying, not the full property value. That means on a £150,000 share, you might need just £7,500 to £15,000 saved, not £30,000+ like you would for a full purchase.

What You Pay: Mortgage, Rent, and Fees

There are three main costs:

- Mortgage payments - based on the share you own. Lenders who offer shared ownership mortgages usually require a 5% to 10% deposit on your portion.

- Rent - paid to the housing association on the portion you don’t own. It’s usually 2.75% to 3% of the unsold share annually, split into monthly payments.

- Service charge - covers building maintenance, communal areas, groundskeeping, and sometimes building insurance. This can range from £50 to £200 a month depending on the property.

You’ll also pay legal fees, valuation fees, and possibly an administration fee to the housing association. These can add up to £1,500 to £3,000 upfront. But compared to saving for a 25% deposit on a £300,000 home (£75,000), it’s a much smaller barrier to entry.

Staircasing: How to Own More Over Time

One of the biggest perks of shared ownership is staircasing - the ability to buy more shares in your home as your finances improve. You can usually buy additional 10%, 25%, or 50% chunks at a time, up to 100%.

Each time you staircase, the housing association gets an independent valuation of the property. You pay for the new share based on today’s market value - not what you originally paid. So if your home has gone up in value, you pay more for the next chunk. But if it’s dropped, you pay less.

Some housing associations charge a fee for each staircase - usually £200 to £500 - and you’ll need a new mortgage to cover the additional purchase. You can’t staircase more than once a year, and you must be up to date on all payments.

Once you own 100%, you stop paying rent. You still pay service charges, but you’re now a full homeowner with the same rights as anyone who bought outright. You can sell, remortgage, or leave the property in your will.

What You Can’t Do

Shared ownership isn’t a free pass. There are rules:

- You can’t sublet your home unless the housing association gives special permission - usually only for temporary situations like work relocation.

- You can’t make major structural changes without written approval.

- You must keep up with all payments. Miss a rent or service charge payment, and you risk losing your home - even if you’ve paid off 80% of it.

- You can’t sell to just anyone. If you want to sell your share, the housing association has the right to find a buyer first. They have a set period (usually 8 to 12 weeks) to find someone eligible for shared ownership. Only if they can’t find someone can you sell on the open market.

Shared Ownership vs. Help to Buy

Many people confuse shared ownership with Help to Buy. They’re not the same.

Help to Buy gave first-time buyers an equity loan of up to 20% (40% in London) to help them buy a home outright. The government didn’t own part of the house - you did. You paid no rent. But you had to repay the loan when you sold, or after 25 years, with interest.

Shared ownership means you own only part of the home, and you pay rent on the rest. There’s no government loan involved - just a mortgage on your share. It’s more flexible long-term, especially if you’re not sure you’ll be able to afford a full mortgage in the future.

Help to Buy ended in 2023. Shared ownership is still active and growing, especially in cities where prices are rising faster than wages.

Real-Life Example: Sarah’s Story

Sarah, 31, works as a nurse in Manchester. She saved £12,000 over three years. She found a two-bedroom shared ownership flat listed at £220,000. She bought a 50% share - £110,000 - with a 10% deposit of £11,000. Her mortgage was £550 a month. Rent on the other half was £240 a month. Service charge was £80. Her total monthly cost: £870.

She could have rented a similar flat for £1,100. She’s now paying less than rent, and building equity. After two years, she staircase to 75%. The property had risen to £240,000. She paid £60,000 for the extra 25% share. Her rent dropped to £120 a month. Her mortgage rose to £720. Total monthly cost: £800. She’s now on track to own 100% in five more years.

Is Shared Ownership Right for You?

Shared ownership is ideal if:

- You want to own a home but can’t afford the full deposit or mortgage

- You’re okay with paying rent - even if you own part of the property

- You plan to stay put for at least five years to make staircasing worthwhile

- You’re comfortable with rules around renovations and resale

It’s not ideal if:

- You want complete freedom to renovate or rent out your home

- You expect to move frequently

- You’re unsure you’ll be able to afford future staircasing payments

Many people think shared ownership is a second-tier option. But for tens of thousands of people in the UK, it’s the only path to homeownership. It’s not perfect, but it’s real - and it works.

Can I ever own 100% of a shared ownership home?

Yes. You can buy additional shares in your home over time through a process called staircasing. Most housing associations allow you to staircase up to 100% ownership. Once you own the whole property, you no longer pay rent, only service charges and maintenance fees. You become a full homeowner with the same rights as anyone who bought outright.

Do I need a good credit score for shared ownership?

Yes. While lenders for shared ownership are often more flexible than standard mortgage providers, you still need a credit history that shows you can manage regular payments. A history of missed payments, defaults, or high levels of unsecured debt can disqualify you. Some lenders specialize in shared ownership mortgages and may accept lower credit scores if you have a stable income and low debt-to-income ratio.

What happens if I can’t afford to staircase?

You don’t have to staircase at all. You can stay in your home indefinitely, owning your original share and paying rent on the rest. Many people choose this route - especially if property values rise and staircasing becomes too expensive. You still benefit from lower monthly costs than renting and the security of owning part of your home.

Can I sell my shared ownership home?

Yes, but there are restrictions. If you want to sell, the housing association has the first right to find a buyer who qualifies for shared ownership. They typically have 8 to 12 weeks to do this. If they can’t find someone, you can sell on the open market. You’ll get the full sale proceeds for the share you own. For example, if you own 60% and sell for £240,000, you get £144,000. You don’t share the profit with the housing association.

Are shared ownership homes only new builds?

Most shared ownership homes are new builds because housing associations develop them specifically for this scheme. But some older properties are also offered, especially if they’ve been refurbished or are part of a regeneration project. It’s less common, but possible. Always ask whether the property is new or existing before applying.