Shared Ownership Cost Calculator

Calculate Your Costs

Enter your desired share percentage and property value to see estimated monthly costs.

Estimated Monthly Costs

Total monthly cost for your shared ownership arrangement

Comparison to renting:

Buying a home in New Zealand feels impossible for many. Prices keep climbing, deposits feel like mountains, and renting feels like throwing money away. But what if you could own a piece of a home without needing to buy the whole thing? That’s where property shares come in.

What Exactly Are Property Shares?

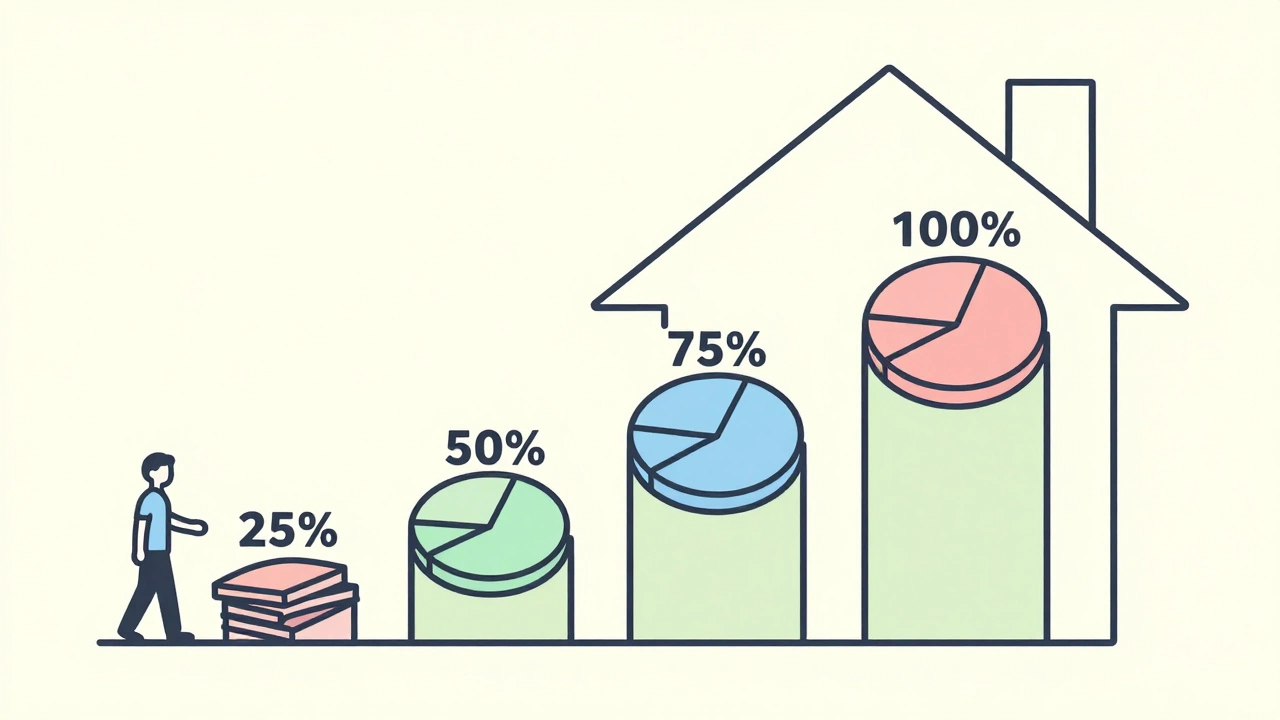

Property shares aren’t stocks or crypto. They’re a part of a house you actually live in. Think of it like buying a slice of a pie - you own a percentage of the property, and the rest is owned by a housing association or government-backed provider. You pay rent on the part you don’t own, and you pay a mortgage on the part you do.

For example, you might buy a 25% share in a three-bedroom house in Papatoetoe. You live there full-time. You pay a mortgage on your 25%. You pay rent on the other 75% to the housing provider. Over time, you can buy more shares - this is called staircasing.

This system was created to help people who earn too much for social housing but can’t afford a full mortgage. It’s not a rental. It’s not a lease. It’s ownership - just split.

How Do You Buy a Share?

It’s not like walking into a real estate office and signing on the dotted line. Here’s how it actually works:

- You find a shared ownership property listed by an approved provider - like Kāinga Ora, Habitat for Humanity, or a registered housing association.

- You check if you qualify. Income limits vary, but generally, you can’t earn more than $120,000 a year as a single person or $160,000 as a couple in Auckland.

- You get pre-approved for a mortgage on the share you want to buy. Not all lenders offer these loans, so you’ll need one that does - think Kiwibank, BNZ, or some credit unions.

- You pay a deposit, usually 5-10% of your share’s value. So if your 30% share is worth $210,000, your deposit might be $10,500-$21,000.

- You sign two contracts: one for your mortgage, one for your tenancy agreement on the rest.

You don’t need to save for a full $800,000 house. You save for a $200,000 share. That’s the game-changer.

What Are the Costs? Rent, Mortgage, and Fees

It’s not just a mortgage. You’ve got three ongoing costs:

- Mortgage payments - on the share you own. Interest rates are the same as regular home loans.

- Rent - on the part you don’t own. This is usually 2.75% of the housing provider’s share value per year. So if they own $560,000 of the property, your annual rent is around $15,400, or $1,283 a month.

- Service charges - these cover building maintenance, insurance, groundskeeping, and sometimes lifts or security. These can range from $300 to $800 a year, depending on the building.

Compare that to renting a similar property outright: you might pay $700-$900 a week in rent with zero equity. With property shares, your rent portion is lower, and every mortgage payment builds your ownership.

Staircasing: How to Own More Over Time

This is where shared ownership gets really powerful. You don’t have to stay at 25% forever. You can buy more shares - 10%, 20%, even 100%.

Here’s how it works:

- You wait until you can afford it - usually after a year or two of stable income.

- You get the property valued by an independent surveyor approved by the provider.

- You pay for the extra share at today’s market price. If your home went up from $700,000 to $850,000, your 10% share isn’t $70,000 anymore - it’s $85,000.

- You take out a new mortgage for the additional share.

- Your rent goes down by the amount of the new share you bought.

Some people staircase to 50%, then 75%, then finally 100%. Once you own 100%, you own the whole home. No rent. No provider. Just a regular mortgage - and full rights to sell or leave it in your will.

What Happens When You Want to Sell?

You can sell your share anytime. But you can’t just list it on Trade Me.

The housing provider has the first right to buy it back. If they don’t want it, they’ll help you find another eligible buyer - someone who also qualifies for shared ownership. You can’t sell to just anyone.

When you sell, you get the full market value of your share. If your 40% share is worth $340,000, you walk away with $340,000 (minus legal fees and any outstanding mortgage).

Important: you don’t get a cut of the overall property’s rise in value - you get your exact percentage. If the house went from $700,000 to $1 million, your 40% share went from $280,000 to $400,000. You keep the $120,000 gain. That’s yours.

Who Can Apply?

It’s not open to everyone. Here’s who qualifies:

- You must be a New Zealand citizen or permanent resident.

- Your household income must be below the local limit (varies by region - $120k-$160k in Auckland).

- You can’t currently own another home - anywhere in the world.

- You must be able to afford the mortgage on your share, plus rent and fees.

- You can’t be in serious debt or have recent bankruptcy.

It’s designed for first-time buyers, young families, or people who’ve been renting for years and want to get on the ladder. It’s not for investors. You can’t buy a shared ownership property to rent out.

Pros and Cons - The Real Picture

Let’s be honest. Shared ownership isn’t perfect. Here’s what works - and what doesn’t.

| Pros | Cons |

|---|---|

| You can own a home with a smaller deposit | You pay rent - even though you own part of it |

| Equity grows as your share increases | Selling is slower - you need approved buyers |

| Lower monthly costs than full rent | Staircasing can get expensive if property values jump |

| More control than renting - you can renovate | Some providers charge high fees for staircasing or selling |

| You can eventually own 100% | Not all lenders offer shared ownership mortgages |

The biggest complaint? Paying rent on part you don’t own. But if you compare it to renting the same property without any equity, it’s still a win. You’re building something real.

What Happens If You Can’t Pay?

Everyone worries about this. If you fall behind on your mortgage, you risk losing your share - just like a regular home loan. But if you fall behind on rent? The housing provider can’t kick you out immediately. They have to follow legal steps, and many offer support programs to help you catch up.

Some providers have hardship funds. Others work with financial counselors. The goal isn’t to evict you - it’s to help you stay in your home.

Is This Right for You?

Ask yourself these questions:

- Do you want to own a home but can’t save for a full deposit?

- Are you okay with paying rent - even if it’s lower than market rates?

- Do you plan to live here for at least 3-5 years? (Staircasing takes time.)

- Are you comfortable with some rules? (No subletting, renovations need approval.)

- Do you want to eventually own the whole thing?

If you answered yes to most of these, shared ownership could be your best shot at homeownership.

Where to Start in New Zealand

Start with these providers:

- Kāinga Ora - the biggest player. Offers shared ownership across Auckland, Wellington, and Christchurch.

- Habitat for Humanity NZ - focuses on low-income families. Often has lower income limits.

- Whai Rawa - Māori-led housing trust with shared ownership options in Tāmaki Makaurau.

- Community Housing Providers - search the Community Housing Register on the Ministry of Housing website.

Visit their websites. Attend an info session. Talk to a mortgage broker who’s handled shared ownership before. Don’t just rely on real estate agents - most don’t know how it works.

Final Thought: It’s Not a Shortcut - It’s a Bridge

Shared ownership won’t make you rich overnight. It won’t solve the housing crisis. But for thousands of people in Auckland, it’s the only way they’ve ever gotten a front door key.

It’s not perfect. It’s not easy. But it’s real. And for the first time in years, you might actually be able to call a place yours - even if you don’t own all of it yet.

Can you rent out your shared ownership property?

No. Shared ownership homes are for your own occupation only. You cannot sublet, Airbnb, or rent out any part of the property. The rules are strict about this - it’s designed for owner-occupiers, not investors.

Can you get a shared ownership home if you’ve owned property before?

Usually not. Most schemes require you to be a first-time buyer. But there are exceptions if you’ve lost your home due to divorce, domestic violence, or bankruptcy - and you don’t currently own anything. You’ll need to prove your situation to the provider.

Do you pay stamp duty on shared ownership?

No. New Zealand doesn’t have stamp duty. You do pay legal fees and a valuation fee when you buy your share, and another valuation when you staircase. These usually cost $1,000-$2,500 total.

What if the property value drops?

You still owe the mortgage on your share, even if the home’s value falls. But you can pause staircasing until the market recovers. You won’t lose your home unless you default on payments. Your rent is based on the provider’s share, not market value.

Can you leave your shared ownership home to someone in your will?

Yes - but only to someone who qualifies for shared ownership. You can’t leave it to a child who earns too much. The provider will need to approve the new owner. If no one qualifies, the provider buys back your share at market value.