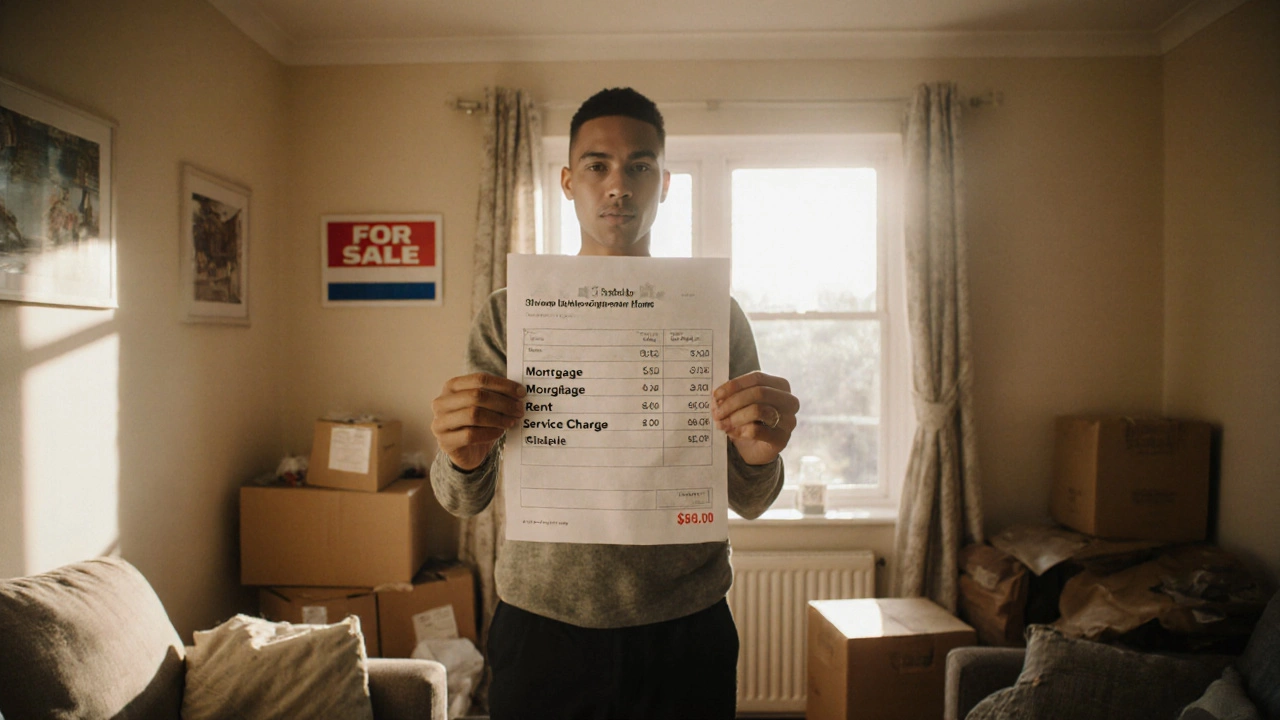

Shared Ownership: A Simple Way to Get on the Property Ladder

Looking for a home but the price tag feels out of reach? Shared ownership lets you buy a slice of a house and rent the rest. It’s a mix of buying and renting that can lower your deposit, cut monthly payments and still give you a foot on the property ladder. Below you’ll find the basics and practical steps to start your journey.

What Exactly Is Shared Ownership?

In a shared ownership deal you purchase a percentage of a property – usually between 25% and 75% – from a housing association or a private developer. The remaining share stays owned by the landlord, and you pay rent on that part. Over time you can buy more shares (called “staircasing”) until you own 100% of the home, if you wish.

The key benefit is that you only need a mortgage for the part you own, so the deposit and loan size are smaller. This means lower monthly costs compared to a full mortgage, and you can still build equity as the value of your share grows.

How to Get Started with Shared Ownership

First, check if you’re eligible. Most schemes require you to be a first‑time buyer, a former homeowner, or someone who can’t afford a full purchase. You’ll also need to meet the income limits set by the housing association, which vary by region.

Next, find a property that offers a shared ownership scheme. Use the Loncor Property Solutions search filters – select “Shared Ownership” under the property type and set your budget. When you spot a home you like, arrange a viewing and ask the seller for the exact share percentage and rent rate.

Once you decide, you’ll need a mortgage for the share you’re buying. Many lenders have special shared‑ownership products, so talk to a mortgage broker about the best rates. You’ll also sign a lease for the rented portion and agree on service charges and ground rent.

After moving in, you can start planning to staircase. Look at the market value of the whole property and decide how much more you want to buy. Keep an eye on any fees – there’s usually a small cost for each staircasing transaction.

Remember, shared ownership isn’t a free pass. You’ll still pay rent, service charges, and possibly higher interest rates than a standard mortgage. But for many buyers, the lower entry cost outweighs those ongoing expenses.

If you’re unsure whether this is right for you, talk to a Loncor advisor. They can run the numbers, compare shared ownership to buying outright, and help you choose the path that fits your budget and long‑term plans.

Shared ownership can turn a dream of owning a home into a realistic goal. With the right research, a clear budget and a trusted partner, you can lock in a share of a property today and work toward full ownership tomorrow.